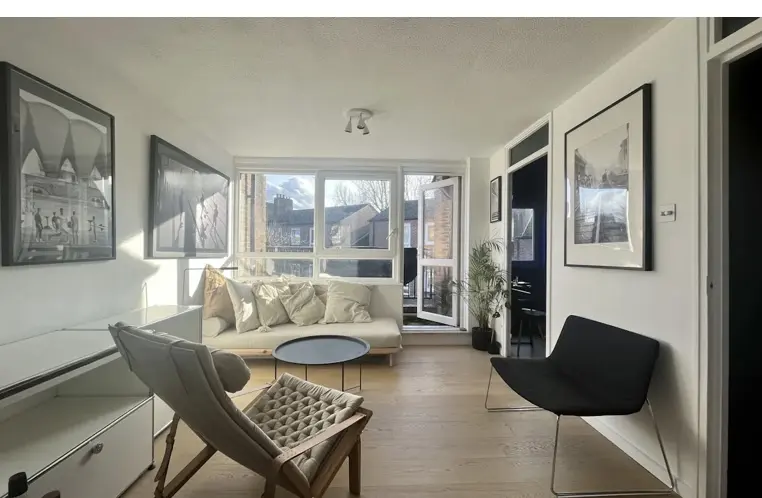

Modern 1-Bed Flat for Sale | Private Balcony & Parking | Near Sevenoaks Station

Sevenoaks TN13 1FD, UK

£325,000

When buying or selling a property in the UK, the term "property survey" often comes up, but its importance can sometimes be overlooked. For both buyers and sellers, understanding the role of a property survey is essential to ensure a smooth transaction and avoid potential pitfalls. In this guide, we’ll break down what property surveys are, why they matter, and how they impact house sales in the UK.

What is a Property Survey?

A property survey is an in-depth inspection of a house carried out by a qualified surveyor. Its purpose is to detect any problems with the building, from structural defects to more hidden issues. This enables buyers and sellers to better understand the condition of a property.

Several types of property surveys exist, depending on the property and the buyer's needs, including:

Why Are Property Surveys Important? For Buyers:

Common Issues Revealed by Property Surveys

Structural defects, such as subsidence or wall cracks.

Roofing issues, including leaks or broken tiles.

Damp, mould, or poor insulation.

Faulty plumbing, heating, or electrical systems.

Signs of woodworm or other pest infestations.

Early identification of these problems saves both buyers and sellers from unpleasant surprises later on.

How Property Surveys Affect House Sales in the UK

Negotiation Leverage:

A survey provides the buyer with a basis for renegotiating the sale price if substantial repairs are required. For a seller, a pre-sale survey establishes the condition of the property and helps justify the asking price.

Confidence in the Sale:

A clean survey report gives buyers confidence to proceed with the purchase. For sellers, addressing survey issues in advance reduces the risk of buyers pulling out.

Legal Compliance:

Sometimes, a survey may reveal problems that need to be rectified to meet legal standards, such as compliance with building regulations.

When Should You Get a Property Survey?

Buyers: Conduct a survey after your offer has been accepted but before exchanging contracts.

Sellers: It may be beneficial to commission a survey before selling to identify and rectify problems.

How Much Does a Property Survey Cost in the UK?

The cost of a survey depends on the type and complexity of the property:

Mortgage Valuation: £150–£300, usually covered by the lender.

Homebuyer Report: £400–£700.

Building Survey: £600–£1,500.

Although these costs might seem high, they are well worth the investment to potentially save you from unexpected repairs.

Choosing the Right Surveyor

Always hire a surveyor who is registered with the Royal Institution of Chartered Surveyors (RICS). RICS-accredited surveyors adhere to strict professional standards, ensuring a reliable and accurate report.

Conclusion

A property survey is an indispensable part of the house sale process in the UK, providing a layer of protection and assurance for buyers, sellers, and lenders alike. By identifying potential problems early, you can confidently navigate the property transaction, whether you’re buying your dream home or selling a cherished property.

If you are unsure about the type of survey suitable for your needs or would like further advice on property transactions, consult a trusted estate agent or surveyor to guide you through the process and make it as smooth as possible.

Disclaimer

This article is for general informational purposes only and does not constitute legal, financial, or professional advice. While we strive to ensure accuracy, property laws, regulations, and market conditions may change over time. We do not guarantee the completeness, reliability, or current validity of the information provided. Readers should independently verify details and seek professional guidance before making any property-related decisions. We are not liable for any losses or damages resulting from reliance on this content

Sevenoaks TN13 1FD, UK

£325,000

Potier St, London SE1 4UX, UK

£394,000