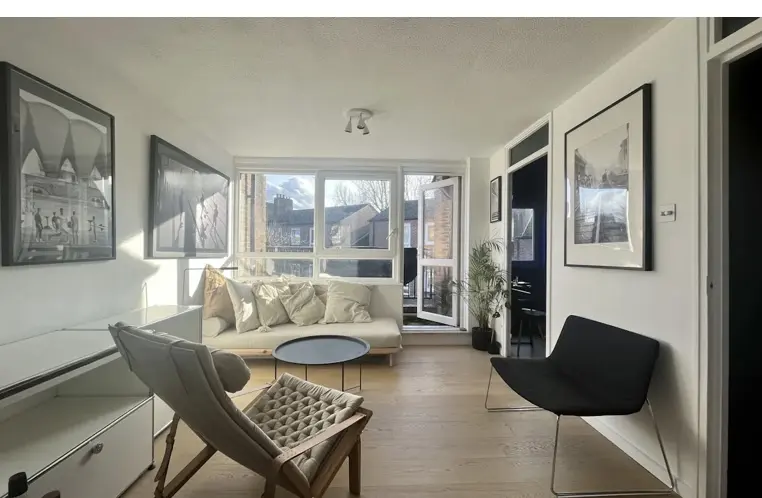

Modern 1-Bed Flat for Sale | Private Balcony & Parking | Near Sevenoaks Station

Sevenoaks TN13 1FD, UK

£325,000

Owning a home has long been a dream for many in the UK. With rising property prices, that dream can often feel out of reach. Shared ownership, a government-backed scheme, is designed to make homeownership more attainable. Here’s a clear, professional guide to help you determine if shared ownership is right for you.

What Is Shared Ownership?

Shared ownership allows you to buy a share of a property—usually between 25% and 75%—while paying rent on the rest. It reduces upfront costs like deposits and mortgages, making it accessible to those who might otherwise struggle to buy outright.

Who Is Eligible for Shared Ownership?

To qualify for shared ownership, you must:

-Have a household income of £80,000 or less (£90,000 in London).

-Be a first-time buyer, someone who previously owned a home but can’t afford one now, or unable to buy a suitable home on the open market.

-Meet local connection criteria, if applicable (e.g., living or working in the area).

-Be aged 18 or over and able to obtain a mortgage for the share you wish to purchase.

If you meet these criteria, shared ownership could be a viable way onto the property ladder.

How Does It Work?

The shared ownership process typically includes these steps:

-Find a Property: Search for eligible properties through housing associations or developers.

-Buy Your Share: Purchase a share that aligns with your budget and financial capacity.

-Pay Rent: Rent is paid on the share owned by the housing association or other organisation. Note: rent does not contribute toward buying additional shares.

-Staircasing: Over time, you can buy additional shares in the property, potentially owning 100%.

Who Owns the Remaining Share?

The remaining share is usually owned by a housing association, but it could also be held by other organisations. These entities act as landlords for the portion you rent. Be sure to clarify ownership and lease terms.

Leasehold vs. Freehold Properties

Most shared ownership properties are leasehold. If you staircase to 100% ownership, houses may convert to freehold, while flats generally remain leasehold. Always check the specific terms for your property.

How Are Properties Selected for Shared Ownership?

Shared ownership properties are often new builds developed under affordable housing schemes. Local councils and housing associations select properties based on demand, location, and funding to ensure affordable housing is available where it’s most needed.

Benefits of Shared Ownership

-Lower Costs: Smaller deposits and mortgages make homeownership more accessible.

-Affordable Rent: Rent on the remaining share is typically below market rates.

-Flexibility: Increase ownership gradually as your finances improve.

-Path to Full Ownership: Staircasing provides a route to owning 100% of the property.

Considerations

Before committing, keep in mind:

-Extra Costs: Service charges, maintenance, and staircasing fees can add up.

-Resale Restrictions: The housing association often has the first right to buy back your share, which can complicate selling.

-Eligibility Rules: Some restrictions may apply to who can buy or how the property is used.

Common Misconceptions

-“I can’t own the property outright.” False. You can eventually own 100% through staircasing.

-“It’s only for young buyers.” Incorrect. Shared ownership is open to all ages who meet eligibility criteria.

-“Shared ownership properties are low-quality.” Not true. Properties vary in size and type, from apartments to family homes.

Is Shared Ownership Right for You?

Shared ownership is ideal for those unable to buy outright but eager to own a home. However, it’s crucial to evaluate your long-term finances, including rent, service charges, and staircasing costs. Seeking professional financial advice can help ensure shared ownership aligns with your goals.

Conclusion

Shared ownership is a practical and increasingly popular way to make homeownership achievable in the UK. With lower initial costs and the flexibility to increase ownership over time, it offers a valuable pathway for many aspiring homeowners.

If you’re considering shared ownership, research thoroughly and understand the terms. With the right approach, this scheme could be your key to homeownership.

Disclaimer

This article is for general informational purposes only and does not constitute legal, financial, or professional advice. While we strive to ensure accuracy, property laws, regulations, and market conditions may change over time. We do not guarantee the completeness, reliability, or current validity of the information provided. Readers should independently verify details and seek professional guidance before making any property-related decisions. We are not liable for any losses or damages resulting from reliance on this content

Sevenoaks TN13 1FD, UK

£325,000

Potier St, London SE1 4UX, UK

£394,000