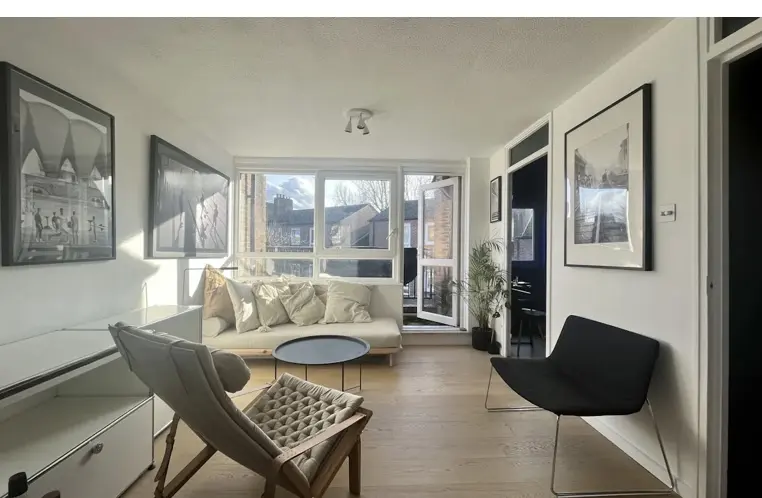

Modern 1-Bed Flat for Sale | Private Balcony & Parking | Near Sevenoaks Station

Sevenoaks TN13 1FD, UK

£325,000

The UK property market is always a topic of great interest, and 2025 promises to be no exception. With economic recovery, evolving buyer behaviour, and fluctuating mortgage rates, the landscape is poised for significant changes. In this blog, we explore expert predictions and trends shaping the housing market in the year ahead, covering house prices, mortgage rates, regional variations, government policies, and more.

House Prices: Stabilisation with Gradual Growth

After years of unprecedented price growth followed by a slowdown in 2023-2024, experts anticipate a more stabilised housing market in 2025. The Royal Institution of Chartered Surveyors (RICS) has forecasted modest price growth across most regions, driven by steady demand and constrained supply. Some areas may experience stronger increases, particularly those benefiting from regeneration projects and improved transport links.

Properties are priced more competitively right now due to increased supply, creating opportunities for buyers, particularly investors, to secure good deals. For sellers, patience is key, as properties are taking longer to sell in the current climate.

Mortgage Rates: Gradual Decline

Following significant hikes in interest rates during 2023, mortgage rates are expected to stabilise and decline slightly in 2025. Rightmove reports that five-year and two-year fixed mortgage rates could drop to around 4.0%, down from recent highs, making borrowing more affordable for buyers.

Supply and Demand: A Balanced Approach

The supply of properties entering the market is on the rise, with new listings increasing by 11% compared to the previous year. This increase, paired with a steady level of buyer activity, is creating a more balanced market. Buyers may benefit from having more choice, while sellers need to be prepared for longer sale times due to increased competition.

Regional Variations: Spotlight on Growth Areas

Not all regions are expected to perform equally. Regeneration projects and major infrastructure developments are likely to boost property values in certain areas. For example:

-The Midlands: The HS2 (High Speed 2) rail project is expected to improve connectivity, making areas along its route more attractive to commuters and investors. Economic investments in the region are also spurring job growth and increasing housing demand.

-Northern Powerhouse Cities (e.g., Manchester, Leeds): Strong rental yields, cultural growth, and infrastructure improvements continue to make these cities appealing.

-South West England: Popular among relocators seeking lifestyle properties and benefiting from an increase in remote working opportunities post-pandemic.

Government Policies and Stamp Duty Changes

The UK government’s housing policies will continue to shape the market in 2025. Affordable housing schemes, incentives for energy-efficient homes, and support for first-time buyers will play a key role. However, prospective buyers should be aware of significant changes to Stamp Duty Land Tax (SDLT) taking effect from 1 April 2025:

-The current SDLT threshold of £250,000 will drop to £125,000, meaning more buyers will pay SDLT on lower-priced properties.

-First-time buyer relief will be reduced, with the threshold dropping from £425,000 to £300,000.

These changes are expected to increase upfront costs for many buyers, particularly those purchasing properties in higher-priced areas. Buyers who can act before April 2025 may benefit from lower SDLT rates.

Key Trends to Watch

-Eco-Friendly Homes: Properties with energy-efficient features like solar panels and insulation upgrades will attract higher demand.

-Commuter Towns: Areas with new transport links, like those along the HS2 route, will continue to grow in popularity.

-Rental Market Growth: The rental sector will remain strong, with buy-to-let investments appealing to those looking for steady income.

How to Prepare for 2025

With these changes in mind, buyers and sellers can take steps to make the most of the market:

-Buyers: Investors should capitalise on current competitive pricing, while others may consider completing purchases before April 2025 to avoid higher SDLT rates.

-Sellers: Highlight energy-efficient features and other desirable qualities to stand out in a competitive market. Be patient, as properties may take longer to sell.

-Investors: Focus on emerging areas and properties with long-term growth potential, especially in commuter towns and regeneration zones.

Final Thoughts

The UK housing market in 2025 is poised for a year of stability and opportunity. While house prices are expected to grow modestly, the stabilisation of mortgage rates and increased supply will create a balanced market for buyers and sellers alike. Regional growth areas, government initiatives, and changing stamp duty rules will significantly influence buying and selling decisions.

When navigating the property market, staying informed and consulting professionals is key. Whether you’re buying, selling, or investing, understanding market trends can help you make confident, strategic decisions.

Disclaimer

This article is for general informational purposes only and does not constitute legal, financial, or professional advice. While we strive to ensure accuracy, property laws, regulations, and market conditions may change over time. We do not guarantee the completeness, reliability, or current validity of the information provided. Readers should independently verify details and seek professional guidance before making any property-related decisions. We are not liable for any losses or damages resulting from reliance on this content

Sevenoaks TN13 1FD, UK

£325,000

Potier St, London SE1 4UX, UK

£394,000