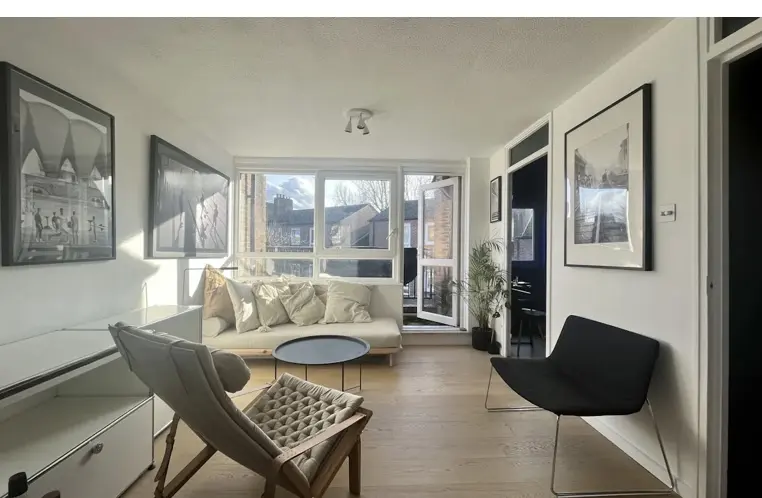

Modern 1-Bed Flat for Sale | Private Balcony & Parking | Near Sevenoaks Station

Sevenoaks TN13 1FD, UK

£325,000

What you should know Probably the most important decision that most people ever make in financial terms, there are a number of so-called hidden costs involved in buying a house. These often catch first-time buyers and even experienced homebuyers off guard in the process. Understanding these costs beforehand can help you be financially prepared for every phase of the homebuying journey.

Here is the most common breakdown of hidden costs when buying a house in the UK.

1. Stamp Duty

The biggest additional costs when buying a property in the UK include the Stamp Duty Land Tax, more commonly known as SDLT. The stamp duty itself is a kind of tax that is payable to the government on the purchase of any property above the specified threshold. You pay an amount dependent upon the price of the property and where it is located.

Stamp Duty Rates: Stamp duty rates for 2024 are as follows: Tiers:

For first-time buyers, there is an exemption on homes bought up to £425,000, and then lower-rated tax on the first £625,000.

Besides that, there is the stamp duty, which most new buyers overlook, their sole focus being on the house price. This can easily set one back thousands of pounds in addition to the general cost, especially for high-value areas.

2. Legal Costs

These are solicitors or conveyancers that must be engaged when purchasing a home. These professionals will ensure a smooth and successful transition in the ownership of property, with all things legally in order.

Solicitor fees are also variable, but you might expect to pay anything between £800 and £2,000 plus VAT depending on the complexity of the transaction. You might also have to pay for additional costs including:

Legal fees could be another more substantial addition to the cost. Hence, it is a good thing to take it into consideration from a very early stage.

3. Survey Costs

It is highly recommended that you arrange a property survey before buying a house to see probable issues in the structure or state of the home. There are many different types of surveys that can be quite varied in cost; these include:

While it may seem an added and unnecessary expense to have a survey, it saves you thousands of pounds further down the line if something is highlighted that you would not have noticed otherwise.

4. Mortgage Fees

With any mortgage, you will most likely have to pay other fees besides just the mortgage itself. Not all lenders charge identical fees, but most charge these common types of fees:

For this reason, you're always best advised having your lender or broker outline the associated fees so you can financially plan accordingly.

5. Removal Costs

In moving into a new home, you will be able to consider removal firms that will help in facilitating your needs for packing, loading, and relocation. Other determining variables when costing removals are determined by the size of your home and the distance of your move.

It's very easy to underestimate how much it may cost to move, but it can certainly add up quickly especially if you have a lot of things to move or are going a long distance from where you currently reside.

6. Property Maintenance and Repairs

Once you have secured the property, there may be continued costs in the forms of maintenance and repairs. Even though the house may appear in great shape, there could be things that will need your immediate attention once you move in.

It would be advisable to immediately make a budget for repairs and maintenance that it requires.

7. Council Tax and Utilities

Then there are the ongoing bills once you move in. The most major one being the Council Tax, which is a tax of a local nature responsible for financing certain local services that include rubbish collection or street cleaning. The amount varies from one place to another and on the value of the property, but in general, it can range from £1,000 to £3,000 yearly.

Also add, on top, £150 to £300 for utilities-so gas, electricity, and water-and broadband.

8. Ongoing Costs of Refurbishing a Property

Not many buyers dream about what it can really cost to refurbish or improve a property. It can be very different according to the extent of the work, whether you will just decorate, build in an extension, or improve the garden. For example:

You can work out whether to carry out extensive changes based on whether these are going to have any impact on your budget when making any major alterations.

Conclusion

While the excitement over buying a house is exhilarating, the financial reality is well known. All these charges include the stamp duty, legal fees, surveys, mortgage fees, moving costs, and ongoing maintenance that might end up quite insupportable, hence make sure you budget for these expenditures in an appropriate manner. If you are conscious of exactly how much it could end up amounting to, you shall be better prepared and avoid a financial surprise or two during the process.

At Argant Estates, we understand well that preparation is the key to your property buying journey. Considering buying and in need of some professional advice or valuation? Don't hesitate to contact us today for a free consultation. Here at Argant Estates, we will make everything run as smooth as possible regarding your property purchase.

Disclaimer

This article is for general informational purposes only and does not constitute legal, financial, or professional advice. While we strive to ensure accuracy, property laws, regulations, and market conditions may change over time. We do not guarantee the completeness, reliability, or current validity of the information provided. Readers should independently verify details and seek professional guidance before making any property-related decisions. We are not liable for any losses or damages resulting from reliance on this content

Sevenoaks TN13 1FD, UK

£325,000

Potier St, London SE1 4UX, UK

£394,000