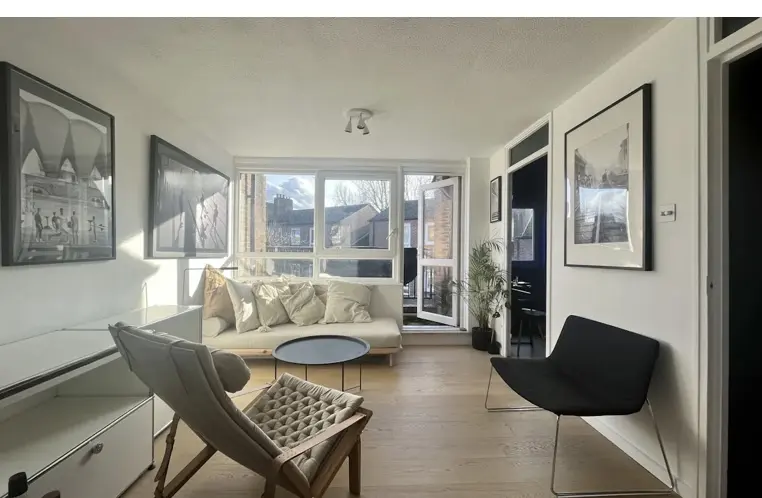

Modern 1-Bed Flat for Sale | Private Balcony & Parking | Near Sevenoaks Station

Sevenoaks TN13 1FD, UK

£325,000

Navigating the housing market in London can feel like a whirlwind, but accepting an offer is just the beginning of the journey. Whether you’re a buyer or seller, understanding the next steps is essential to ensure a smooth transaction. Here’s a clear and engaging guide to what happens after an offer is accepted, tailored specifically to London’s dynamic property market.

Confirm the Offer in Writing

. Once your offer is accepted, the estate agent will provide written confirmation. This document outlines the agreed price and conditions, setting the stage for the next steps

Secure Your Mortgage:

Finalise your mortgage application by providing all required documents to your lender. Most lenders will also require a property valuation to confirm its worth, a step particularly relevant in London’s high-value market.

Instruct a Solicitor or Conveyancer:

Hire a solicitor or licensed conveyancer to manage the legal aspects of your purchase.

They will:

Conduct essential searches (e.g., local authority, drainage, environmental)

. Draft and review contracts

. Oversee the transfer of funds

Arrange a Professional Survey

Beyond the mortgage valuation, a professional survey can identify any structural issues or necessary repairs. This step is crucial in London, where properties vary significantly in age and condition.

Exchange Contracts

Once all checks and searches are complete, you’ll exchange contracts with the seller. This stage is legally binding, and you’ll pay a deposit (typically 10% of the purchase price). Pulling out after this point usually incurs significant penalties.

Complete the Sale

On completion day, the remaining funds are transferred, and ownership is officially yours. You’ll receive the keys and can move into your new London home.

Accept the Offer in Writing

. Confirm the buyer’s offer in writing through your estate agent to formalise the agreement and avoid misunderstandings

. Instruct a Solicitor or Conveyancer

. Engage a solicitor to handle the legalities of the sale

They will:

. Draft the contract

. Respond to enquiries from the buyer’s solicitor

. Oversee the transfer of ownership

Prepare for Property Searches

The buyer’s solicitor will initiate property searches. Be ready to provide essential documents like proof of ownership, title deeds, and records of any renovations or planning permissions.

Respond to Surveys and Valuations

The buyer’s survey may highlight issues requiring renegotiation. Be prepared to address concerns or adjust the price if significant repairs are necessary.

Exchange Contracts

Both parties sign and exchange contracts, making the agreement legally binding. You’ll also confirm the completion date at this stage.

Completion Day

On the agreed date, the buyer’s funds are transferred to your solicitor. Once the funds are received, hand over the keys and vacate the property (unless otherwise agreed). The sale is now complete.

Key Considerations for Both Buyers and Sellers

. Timelines: London transactions often progress quickly, but delays can occur due to legal or financial complexities. Staying organised and responsive is crucial.

. Costs: Buyers should budget for stamp duty, legal fees, and surveys, while sellers must account for estate agent fees and legal expenses.

. Clear Communication: Open lines of communication between estate agents, solicitors, and all involved parties are vital for a seamless process.

Conclusion

The period after an offer is accepted is a pivotal phase in the buying or selling journey. Whether you’re navigating surveys and mortgages as a buyer or handling property searches as a seller, understanding these steps is key to avoiding surprises. With careful preparation and professional support, you can successfully complete your property transaction in London’s competitive housing market.

Whether you’re buying or selling a home, Argant Estates is here to guide you through every step of the process. Contact us today for expert advice and personalised support in London’s housing market.

Disclaimer

This article is for general informational purposes only and does not constitute legal, financial, or professional advice. While we strive to ensure accuracy, property laws, regulations, and market conditions may change over time. We do not guarantee the completeness, reliability, or current validity of the information provided. Readers should independently verify details and seek professional guidance before making any property-related decisions. We are not liable for any losses or damages resulting from reliance on this content

Sevenoaks TN13 1FD, UK

£325,000

Potier St, London SE1 4UX, UK

£394,000