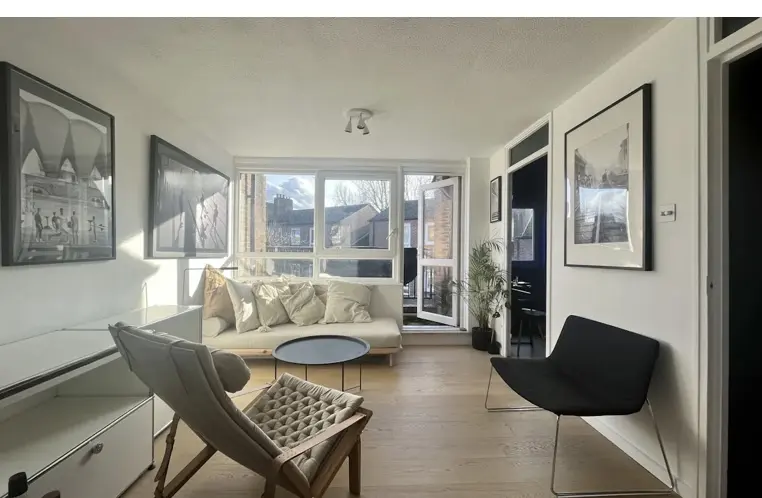

Modern 1-Bed Flat for Sale | Private Balcony & Parking | Near Sevenoaks Station

Sevenoaks TN13 1FD, UK

£325,000

The UK government has announced plans to abolish the centuries-old leasehold system in England and Wales, aiming to replace it with a commonhold ownership model. This potential shift has left many homeowners and prospective buyers seeking clarity on what these changes entail. Here’s a breakdown of what’s happening, the pros and cons, and what this could mean for the future of property ownership.

Understanding Leasehold vs. Commonhold

Before diving into the reforms, it’s crucial to understand the two key property ownership structures:

Leasehold: Traditionally, under the leasehold system, homeowners own their property for a fixed term but not the land it stands on. This arrangement often involves paying ground rent and service charges to a freeholder, who retains ownership of the land.

Commonhold: In contrast, commonhold allows homeowners to own their individual flats outright, with shared ownership of common areas. This model eliminates ground rent and provides residents with greater control over the management of their buildings.

Key Reforms and Their Implications

1.Ban on New Leasehold Flats

The government plans to prohibit the sale of new flats under leasehold agreements, making commonhold the default tenure. This move aims to prevent future homeowners from being subjected to escalating ground rents and restrictive terms.

2.Empowering Existing Leaseholders

For current leaseholders, the reforms propose simplified processes to extend leases or purchase freeholds. Notably, the requirement to wait two years before initiating such actions has been removed, allowing homeowners to act immediately upon acquiring their property.

3.Addressing Unfair Charges

The reforms aim to tackle exploitative practices, such as undisclosed commissions on insurance premiums, which have historically burdened leaseholders with inflated costs.

Pros and Cons of Abolishing Leasehold

Pros:

-Greater Homeowner Control: Commonhold eliminates freeholders, giving homeowners direct control over building management.

-No More Ground Rent: Leaseholders currently pay annual fees to freeholders—this will no longer be required.

-Easier to Sell Properties: Leasehold properties, especially those with short leases, often struggle to sell. Commonhold homes may be more attractive to buyers.

-Simplified Ownership: No more costly lease extensions or service charge disputes.

Cons:

-Challenges in Transitioning: Converting existing leasehold properties to commonhold could be complex and expensive.

-Property Management Responsibilities: Homeowners in commonhold properties will need to manage shared spaces collectively, which could lead to disputes.

-Resistance from Freeholders: Some freeholders may challenge these changes, leading to legal and political delays.

What’s Next?

While the reforms are promising for homeowners, transitioning from leasehold to commonhold won’t happen overnight. The new laws have yet to be passed, and until they do, uncertainty remains about how existing leaseholders will be affected.

For now, leaseholders should stay informed, seek legal advice if necessary, and be prepared for potential changes. Once the law is finalised, we will have a clearer picture of how the property market will adapt to this historic shift.

Key Takeaway: Until these reforms officially pass, we can’t be certain about the full impact. However, if enacted as planned, they could significantly improve homeownership rights in the UK.

Disclaimer

This article is for general informational purposes only and does not constitute legal, financial, or professional advice. While we strive to ensure accuracy, property laws, regulations, and market conditions may change over time. We do not guarantee the completeness, reliability, or current validity of the information provided. Readers should independently verify details and seek professional guidance before making any property-related decisions. We are not liable for any losses or damages resulting from reliance on this content

Sevenoaks TN13 1FD, UK

£325,000

Potier St, London SE1 4UX, UK

£394,000