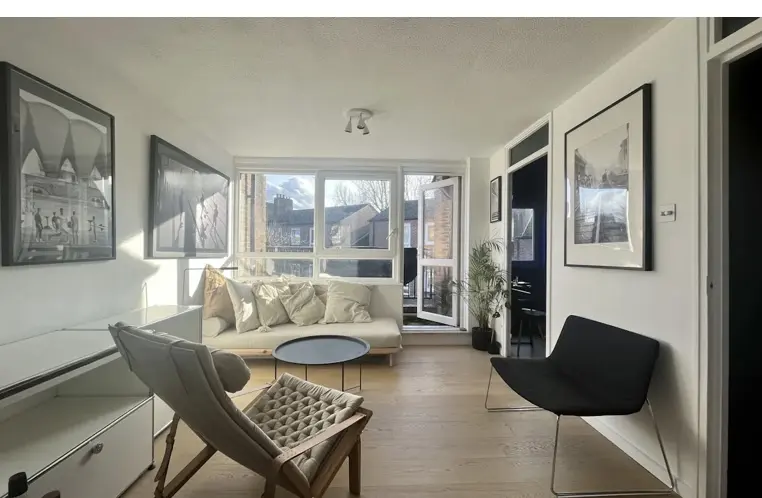

Modern 1-Bed Flat for Sale | Private Balcony & Parking | Near Sevenoaks Station

Sevenoaks TN13 1FD, UK

£325,000

When selling your property, you may find yourself faced with two types of offers: one from a cash buyer and another from a mortgage buyer, with the mortgage buyer offering a slightly higher price. While it’s tempting to accept the higher offer, it’s important to consider both the advantages and drawbacks of each option. At Argant Estates, we’ve broken down the key factors to help you decide which route is best for you.

Pros of Accepting a Lower Cash Offer:

Speed and Convenience: Cash buyers often close quickly, sometimes in as little as a week. If you need a fast sale, this can be a major advantage.

No Financing Contingencies: With cash buyers, there’s no worry about the deal falling through due to financing issues, making the process smoother.

Fewer Closing Costs: Cash transactions generally have fewer fees, saving you money during the closing process.

Less Risk: Since the sale doesn't depend on a mortgage approval, there’s less chance of the deal falling through.

Cons of Accepting a Lower Cash Offer:

Lower Sale Price: Cash buyers typically expect a discount for the convenience and speed they offer, which could result in a lower price for your property.

Limited Negotiation Flexibility: Cash buyers may be firm with their offer, leaving little room for negotiation.

Potentially Less Detailed Inspections: Some cash buyers may waive in-depth inspections, which can lead to unforeseen problems post-sale.

Pros of Accepting a Higher Offer from a Mortgage Buyer:

Higher Sale Price: A mortgage buyer is likely to offer a higher price, potentially resulting in more money for you at closing.

Potential for More Negotiation: With mortgage buyers, there’s often more room to negotiate on the price or terms of the deal.

Cons of Accepting a Higher Offer from a Mortgage Buyer:

Longer Closing Time: Mortgage buyers typically require more time to secure financing, which could delay the sale process.

Risk of Financing Issues: If the buyer’s mortgage falls through or takes longer than expected, the sale might be delayed or canceled.

Higher Closing Costs: Mortgage transactions can involve more fees, potentially costing you more at closing.

Conclusion:

Choosing between a cash offer and a slightly higher offer from a mortgage buyer depends on your priorities. If speed, convenience, and certainty are important to you, a cash buyer might be the way to go. However, if a higher sale price is your primary concern and you're willing to wait for a mortgage buyer to secure financing, then a mortgage buyer may be the better choice.

If interested in selling, call today! Our team of experts at Argant Estates can help you make a quick, seamless sale.

Disclaimer

This article is for general informational purposes only and does not constitute legal, financial, or professional advice. While we strive to ensure accuracy, property laws, regulations, and market conditions may change over time. We do not guarantee the completeness, reliability, or current validity of the information provided. Readers should independently verify details and seek professional guidance before making any property-related decisions. We are not liable for any losses or damages resulting from reliance on this content

Sevenoaks TN13 1FD, UK

£325,000

Potier St, London SE1 4UX, UK

£394,000