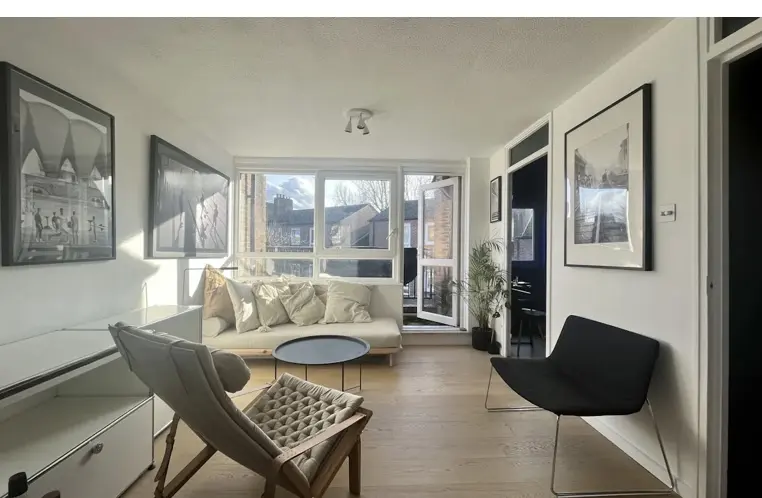

Modern 1-Bed Flat for Sale | Private Balcony & Parking | Near Sevenoaks Station

Sevenoaks TN13 1FD, UK

£325,000

Dealing with probate property can be daunting as it usually arises at a sad point in a life. Property probate in the UK involves a legal process that is required for the assurance of due disposal or proper transfer of any property that the deceased owned. Here is a clear guide to help you manage each step of the property probate process effectively:.

Step 1: Determine Whether the Property Must Be Probated

Not all property is subject to probate. Here's how to determine:

If you are in any doubt, an initial consultation with a solicitor or probate expert will clarify your particular situation.

Step 2: Establish Who the Executor or Administrator Is

Who is in charge of the probate, depending on whether there is a will:

An executor or administrator can, with legal authority, proceed with property matters upon being granted.

Step 3: Value the Property for Inheritance Tax Purposes

For probate properties, the valuation has to be as precise, since it will determine any liability for IHT. The values of all properties must be determined as of the date of death.

The value of the property, along with the other estate assets, determines the overall value of the estate and therefore will determine whether any Inheritance Tax is payable.

Step 4: Inheritance Tax (Where Payable)

UK Inheritance Tax is payable on an estate above £325,000, or £500,000 if it is left to children or grandchildren. What this means for property probate is:

When paid, one is free to apply for a grant of probate-the document giving you the legal ownership of the property.

Step 5: Apply for Grant of Probate or Letters of Administration

Once the Inheritance Tax is done, it is time to apply for either a Grant of Probate or Letters of Administration. This legal document grants you the right to make the actual transfer or sale of the probate property.

Once probate is granted, you are legally allowed to deal with the property. You will now need to determine whether to sell the property or transfer the ownership to beneficiaries.

If selling, remember that probate properties often attract buyers looking for potential investment opportunities, so the condition and location of the property may influence its marketability.

Step 7: Distribute the Proceeds or Transfer Ownership

Once the property is sold or transferred, you will have to wrap up the estate by:

Probate property is complex to manage, and nobody needs to face it alone. Here at Argant Estates, we specialise in selling probate properties, everything from valuation right through to sale. Call us today to book your free valuation and let us confidently guide you through the process.

Disclaimer

This article is for general informational purposes only and does not constitute legal, financial, or professional advice. While we strive to ensure accuracy, property laws, regulations, and market conditions may change over time. We do not guarantee the completeness, reliability, or current validity of the information provided. Readers should independently verify details and seek professional guidance before making any property-related decisions. We are not liable for any losses or damages resulting from reliance on this content

Sevenoaks TN13 1FD, UK

£325,000

Potier St, London SE1 4UX, UK

£394,000