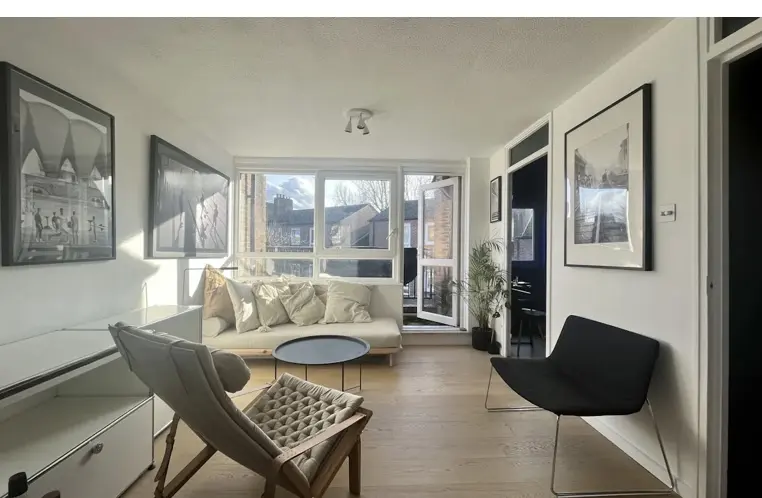

Modern 1-Bed Flat for Sale | Private Balcony & Parking | Near Sevenoaks Station

Sevenoaks TN13 1FD, UK

£325,000

Buying a property is one of the most important financial decisions you will ever make. Whether you are a first-time buyer, seasoned investor, or just looking for a new home, knowing how to identify a good deal is critical. This guide will help you spot red flags to avoid costly mistakes and recognise green lights signalling great opportunities.

-Too Good to Be True Pricing: If a property is significantly cheaper than others in the same neighbourhood, it’s a warning sign. Hidden problems may include structural damage, legal complications, or unfavourable lease terms.

-Poor Condition with Poor Explanation: A fixer-upper can be a great investment, but extensive damage without explanation or history may indicate deeper issues like subsidence, dampness, or pests.

-Short Lease: For leasehold properties, a lease term below 80 years greatly affects resale value and mortgage availability. Extending a lease can be expensive and time-consuming.

-Unclear Legal Ownership: Ensure the property’s title is free from disputes or unsettled claims. Issues like shared access disputes or unregistered land can cause significant legal headaches.

-High Service Charges: Check service charges for flats or leasehold homes. Excessive or rising charges can make the property less viable.

-Unusual Selling Circumstances: Be cautious of rushed sales, ‘as-is’ sales, or limited viewings. These may indicate hidden defects or legal impediments.

Undesirable Location Trends: Even a beautiful home can be a poor investment if the location is in decline or losing infrastructure support. Research local crime rates, schools, and future development plans.

-Fair Market Pricing: A well-priced property that aligns with similar homes in the area indicates it’s fairly valued. Use online tools and market reports to compare prices.

-Good Condition or Manageable Renovations: Properties in sound condition but requiring cosmetic updates often present great opportunities to add value without major repairs.

-Desirable Location: Properties near good schools, transport links, and low crime areas tend to hold their value. Proximity to planned developments, like new transport hubs, is another positive sign.

-Long Lease or Freehold Ownership: Freehold properties and leaseholds with over 90 years remaining appreciate better and are easier to sell.

-Motivated Sellers: Sellers who need to sell quickly, without appearing desperate, may offer room for negotiation. Reasons might include job relocation or downsizing.

-Low Maintenance Costs: A property with updated utilities, a newer roof, or modern insulation can save significantly on future costs.

-Rising Area Popularity: Emerging neighbourhoods with new businesses, transport links, or redevelopment projects often see increased property values. Research what’s planned in the area to assess growth potential.

-Order a Professional Survey: Conduct a comprehensive survey to uncover structural problems and estimate repair costs.

-Check Comparables: Research recent sale prices of similar properties in the area to determine fair market value.

-Employ a Solicitor: A property solicitor can identify legal or ownership issues that might not be immediately apparent.

-Inspect Thoroughly: Visit the property several times at different times of day to assess its condition and surroundings.

Finding a good property deal requires thorough research, attention to detail, and asking the right questions. By understanding the red flags to avoid and the green lights to pursue, you can make an informed decision and secure a property that aligns with your goals, whether for personal use or investment.

When in doubt, consult professionals such as estate agents, surveyors, or solicitors. A little diligence upfront can save you from costly mistakes and help you find a property that truly meets your needs and aspirations.

Disclaimer

This article is for general informational purposes only and does not constitute legal, financial, or professional advice. While we strive to ensure accuracy, property laws, regulations, and market conditions may change over time. We do not guarantee the completeness, reliability, or current validity of the information provided. Readers should independently verify details and seek professional guidance before making any property-related decisions. We are not liable for any losses or damages resulting from reliance on this content

Sevenoaks TN13 1FD, UK

£325,000

Potier St, London SE1 4UX, UK

£394,000