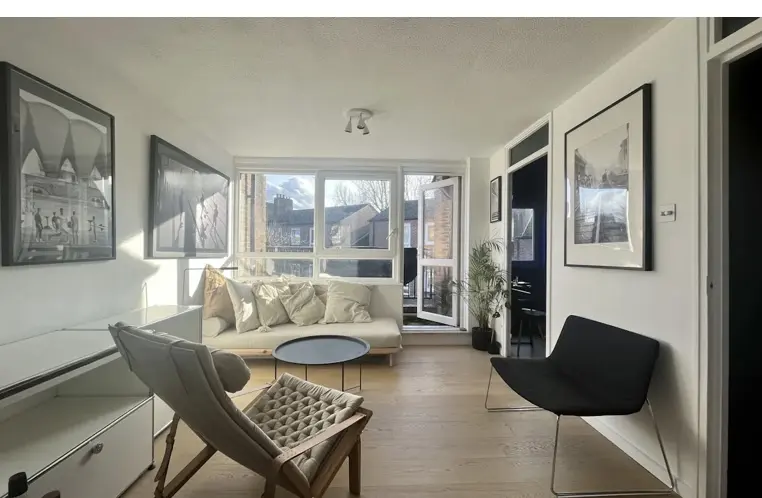

Modern 1-Bed Flat for Sale | Private Balcony & Parking | Near Sevenoaks Station

Sevenoaks TN13 1FD, UK

£325,000

Buying a house in the UK is equally rewarding and complicated. Whether one is a first-time buyer or moving to another property, knowledge of every step is needed right from getting a mortgage to exchanging contracts and finalizing the Memorandum of Sale. Herein comes a simplified yet thorough guide through the journey with confidence.

1. Obtain a Mortgage Agreement in Principle (AIP)

First, you will need to secure a Mortgage Agreement in Principle-an AIP, formerly referred to as a Decision in Principle, or DIP. A Mortgage Agreement in Principle is a document from the mortgage lender that identifies how much they may be able to lend you, based on your income and credit history, together with your expenditures. Although this is not a full mortgage offer, an AIP in itself demonstrates to sellers and estate agents that you are indeed a serious buyer.

-Location: ease of access to and from work and school, public transport links, amenities within walking distance. -Property Condition: obvious signs of wear and tear or requirements for repairs will impact on your budget. -Neighborhood: pecking order regarding safety, feel of community, and planned developments for the future.

You may need to view more than once or twice to make a sure decision. Take your time since house buying is a big decision and you should choose carefully to avoid the stress of buyer's regret.

3. Making an Offer

Found the perfect property? You can now make an offer via an estate agent. What to consider:

-Setting Your Offer: You aren't obligated to offer the asking price. Your offer will be set off of market research, repair costs, and your budget.

-Negotiation (if necessary): You might get a counter-offer back from the seller. If you're buying in a competitive market, you may need to raise your offer to take down the home.

Once accepted, this offer isn't legally binding but serves as an important first step in moving forward.

4. Full Mortgage Application

Once your offer is accepted, you apply for a full mortgage. This is more detailed than the earlier application, and the lender will consider:

-Your Finances: Income, expenditure, and credit history in some detail.

-The Property's Value: The lender will instruct a valuation that confirms the property represents good security for the agreed value.

Processing After this, the lender will provide you with a formal mortgage offer, confirming how much they will lend. Most mortgage offers are valid for around 3-6 months.

5. Instruct a Solicitor or Conveyancer

When you are in receipt of your mortgage offer, you can instruct a solicitor or a licensed conveyancer. They will take care of all the legal issues pertaining to buying a house, including:

-Conducting Searches: They will check for any legal problems with the property-such as problems with land disputes, flood risks, or proposed construction plans.

-Reviewing Contracts: Your solicitor will go through the contract and iron out any issues that may arise, advising you on what to do in terms of the signing of the contract.

-Handling Funds: They take care of the financial transaction involved in your deposit and mortgage funds.

6. Commissioning a Survey - Recommended

While the mortgage lender will conduct a cursory valuation, it makes sense to commission a more detailed survey in search of hidden defects. There are two main types:

-Homebuyer's Report: This is a mid-range survey indicating visible defects. -Full Building Survey: This is a more extensive examination, best used when buying an older or altered property.

You may want to renegotiate the price or ask the seller to carry out repairs if issues are found.

7. Exchanging Contracts

When all checks have been completed by your solicitor and you are satisfied that everything is fine with your property, you will exchange contracts. This stage involves the following:

-Signing of Contracts: You and the seller both sign the final contracts. -Paying a Deposit: You pay 5-10% of the price, typically, on exchange. -Completion Date: This is the date set for both parties to complete the sale and transfer ownership.

At this stage, you are legally bound to buy the property. Withdrawal from the sale after exchanging means that you may forfeit your deposit.

8. The Memorandum of Sale

Once your offer has been accepted, the estate agent will prepare a Memorandum of Sale. This will contain:

The Memorandum of Sale is not legally binding in itself, but it is an official document recording the terms of the sale. It starts the conveyancing process. Ensure that all the details are correct as your solicitor will use this document to start their work.

9. Completion of Sale

On completion day, the balance of the purchase price is paid from your solicitor to the seller's solicitor, and you pick up the keys to your new home. Completion usually occurs some weeks after exchanging contracts, although for some, this may happen on the same day.

Congratulations—once completed, the property is officially yours!

Final Tips for a Smooth Buying Process

Each one of these steps brings you closer to the actual ownership of a home, so you have to make sure you keep yourself organized and take each step as carefully as possible. In this way, having learned about the trip from mortgage application to the Memorandum of Sale, you would be all set for your successful purchase of property in the UK.

Disclaimer

This article is for general informational purposes only and does not constitute legal, financial, or professional advice. While we strive to ensure accuracy, property laws, regulations, and market conditions may change over time. We do not guarantee the completeness, reliability, or current validity of the information provided. Readers should independently verify details and seek professional guidance before making any property-related decisions. We are not liable for any losses or damages resulting from reliance on this content

Sevenoaks TN13 1FD, UK

£325,000

Potier St, London SE1 4UX, UK

£394,000