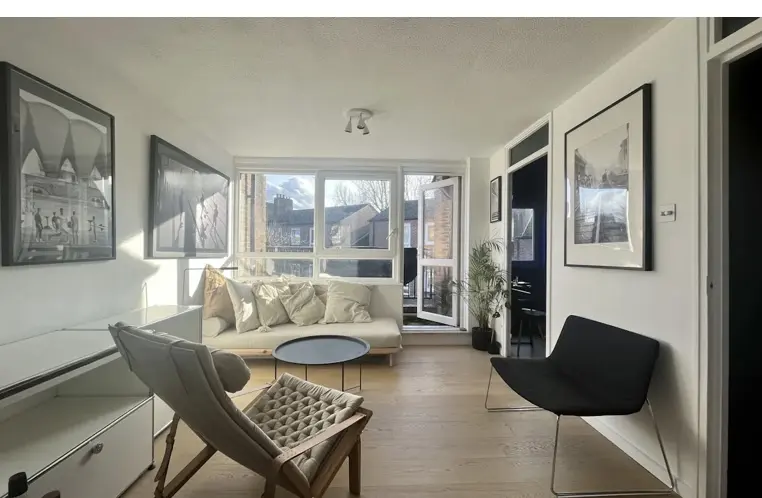

Modern 1-Bed Flat for Sale | Private Balcony & Parking | Near Sevenoaks Station

Sevenoaks TN13 1FD, UK

£325,000

Renting out your main residence is a flexible, practical option-be it for temporary emigration, purchasing a new home, or simply generating an additional source of income. If one is looking to do so in the United Kingdom, then it is well within the realm of possibility; there are, however, a few legal, financial, and tax considerations that might be mentioned. Below is an overview that will help you make sense of what's involved in letting your home and how to ensure it's as painless as possible.

Why Rent Out Your Primary Residence?

Everybody has different reasons why they rent their main home, but the most common include:

Temporary Relocation: If you are going to move for a certain period of time, such as for work or study, then renting out your house can be one great way to help cover your mortgage and maintain ownership.

Upsizing or Downsizing: You may want to retain your home as an investment property once you have moved into your new home.

Financial Flexibility: Additional rental income offers greater financial freedom by covering the costs of a mortgage or financing future investments.

In fact, renting out your principal residence can indeed pay off, but you have to do it right, lest pitfalls arise.

Key Steps to Rent Out Your Primary Residence:

1. Inform the Mortgage Lender

Where a residential mortgage is placed on the property, one of the first steps to take would involve the mortgage lender. Most mortgages have the proviso that the property should serve only as a principal residence. Lenders may grant what is called a "consent to let, permission to rent your home on a temporary basis. Some lenders charge a fee or change your mortgage interest rate when you switch over to a buy-to-let status, and it's important to check with your provider.

If you intend to rent the property on a long-term basis, then you may have to remortgage onto a buy-to-let mortgage, which is a type designed for rental properties.

2. Check Your Lease (If Leasehold)

If your property is leasehold, then you need to check your lease to ensure there are no restrictions on subletting or renting. Some leases contain a clause banning or demanding permission from the freeholder or managing agent to rent out the property.

3. Understand Your Tax Implications

Income is derived in the UK, and therefore, whatever money you achieve through letting your property will be required to be declared to HM Revenue & Customs. There are, however, some benefits to landlords in connection with tax: Lettable Expenses: You can offset certain expenses, such as maintenance costs, property management fees, and insurance against your rental income.

Capital Gains Tax (CGT): In the long run, when you sell the property, you will be liable to pay CGT on the gain. You do get some tax relief for the period the properties were once your main residence.

Of course, you should consult a tax professional to make sure that you meet all your obligations but also make sure you use all the available tax reliefs.

4. Set Up Landlord Insurance

Your standard home insurance policy may not include rental activities, and therefore you will need landlord insurance to help you be adequately covered against such risks as damages caused by tenants, loss of rental income, and liability arising from injuries occurring on the property. Generally, landlord insurance will cover both the building and the contents that you are leaving behind; however, it is best to discuss your specific needs with an insurance provider.

5. Meet Landlord Responsibilities and Regulations

UK landlords have a statutory obligation to meet at least the minimum legal requirements in relation to their tenanted properties. These are summarised below:

Gas Safety: You'll need to have an annual gas safety inspection done by a registered engineer and give the certificate to your tenant.

Electrical Safety: All electrical systems and appliances should be safe; regular inspections are recommended.

Energy Performance Certificate: You will require an EPC rating of at least 'E' before renting out the property.

Smoke and Carbon Monoxide Alarms: Fit smoke alarms on every floor, and carbon monoxide alarms in rooms containing fuelburning appliances.

Of equal importance is protection of the tenant's deposit in a government-approved tenancy deposit protection scheme on the first day of tenancy, and provision of legally required information.

6. Prepare the Property to Let

Your property should be safe, clean, and in good condition when the tenants take over. If your home is filled with personal belongings or valuable items, you might consider removing them for storage. This will create a comfortable, well-maintained living environment which could make good tenants want to rent your home and give you an increased rental return.

7. The Right Rent Price

Research the local market rates to determine a fair rental price that will attract tenants and not undercut your potential income. Overpricing is often met with longer vacancy periods, and underpricing can have consequences for your financial return. Set a competitive rate with the help of local agents or an online calculator.

Key Considerations Before Renting Out Your Primary Residence

Though renting out your primary residence can be quite profitable, it is certainly not without its drawbacks. Here are a few more things to consider in order to make your decision as well-rounded as possible:

-Property Maintenance and Management: Renting involves some property maintenance and repair responsibilities. Determine how you will manage the property-either yourself or using an agent.

-Tenancy Agreements: Use a proper tenancy agreement that protects your rights and spells out all the responsibilities of both parties. Depending on what you plan, you can go for either a short-term agreement of 6 months or a long-term one for 12 months.

-Screening of Tenants: Good tenants are what you require to have an effective tenancy. Proper screening, including reference checks, will go a long way in reducing potential issues.

Letting out your main residence can be very flexible to generate income, though it allows one to retain their property for long-term investment. This, however, involves a great deal of legal requirements, tax obligations, and insurance needs that you shall have to keep in mind.

If you are considering letting your home and seeking professional advice on how best to do so, look no further than the team at Argant Estates today. Our experts can only offer bespoke advice but also guide you through each stage of the process to make letting your property a real breeze. Get in touch today to have a discussion about your goals and to find out more about how we can help!

Disclaimer

This article is for general informational purposes only and does not constitute legal, financial, or professional advice. While we strive to ensure accuracy, property laws, regulations, and market conditions may change over time. We do not guarantee the completeness, reliability, or current validity of the information provided. Readers should independently verify details and seek professional guidance before making any property-related decisions. We are not liable for any losses or damages resulting from reliance on this content

Sevenoaks TN13 1FD, UK

£325,000

Potier St, London SE1 4UX, UK

£394,000