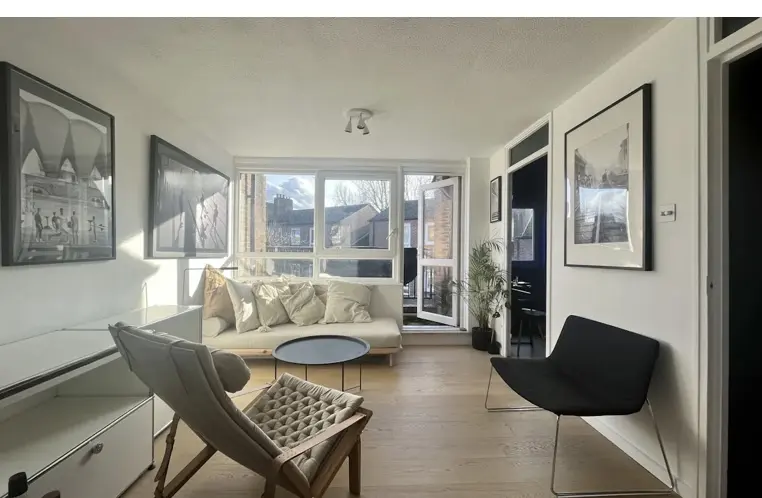

Holiday Let Available in W5 – Flexible Stays (Up to 3 Months)

Windermere Rd, London W5 4TH, UK

£2,000 / Month

Property investing in the UK has been a popular option for those who spot opportunities. The UK housing market, known for property price fluctuations and rental demand, is a high-risk, high-reward for long-term investors. With the rise of artificial intelligence (AI), the landscape of real estate investing is changing. AI has the tools to help investors make better decisions, optimise their portfolios and get more returns. This guide shows you how to use AI to become a property investor in the UK and, step by step, how to use the tools.

What is AI in Property Investing

What is AI?

Artificial Intelligence is the simulation of human intelligence in machines that can think and learn. AI includes machine learning, natural language processing and computer vision, which can process large amounts of data much faster than humans.

Why use AI in Property Investing?

Data Analysis - AI processes vast amounts of data to find trends and patterns that humans miss. This includes market conditions within the property market, property values and rental yields. By using AI, investors can get deeper insights into the market and make better decisions that can result in higher returns.

Predictive Analytics - AI models predict future property values and market trends from historical data. Predictive analytics can help investors forecast property value changes and tax implications for capital gains. This predictive ability allows investors to see market movements and make strategic investments that will grow over time.

Automation - AI automates mundane tasks, property management and customer service so investors can focus on strategy and decision-making. Automation = more efficiency, and lower operational costs = more profit.

Risk Management - AI assesses risk more accurately by looking at many factors and providing insights on the risk and return of different investment options. This helps investors reduce risk and make better investment decisions.

How AI Changes Property Investing

Property Search and Analysis:

Better Search Algorithms - Finding the right property is the first step in any investment journey; seeking advice from estate and local agents can make a big difference. AI-powered platforms recommend properties based on investors’ preferences and past behaviour. These algorithms look at location, budget, and property type to make the search more efficient and targeted.

Market Analysis - AI tools look at market trends to find up-and-coming areas so investors buy properties in areas of high growth. This means higher returns and more profitable investments.

Valuation Models - AI valuation models estimate a property’s current market value and future growth more accurately than traditional methods. When buying a property, you must get building insurance between exchange and completion to protect your investment. These models help investors make better decisions on property purchases.

Due Diligence and Risk Assessment

Automated Due Diligence - Due diligence is key in property investing to ensure you’re making a good investment. Before completion, you must exchange contracts and get building insurance to secure the property and protect your investment. AI systems gather and analyse data on a property’s history, crime rates in the area, school quality and more. This gives investors a heads-up on potential pitfalls and helps them make better decisions.

Risk Analysis - AI looks at property risk factors, economic conditions, market volatility and tenant reliability so investors can make better decisions. This reduces the chance of surprises and increases investment security.

Financing and Mortgages with a Mortgage Broker

Loan Recommendations - Financing can be a complicated process. AI matches investors with the right loan products based on their financial profile and investment goals. This personal approach means better loan terms and more options.

Credit Scoring - AI credit scoring models assess an investor’s creditworthiness more accurately. This means better loan terms. This makes the financing process easier and faster.

Property Management

Tenant Screening - Managing properties can be a time-consuming process. AI looks at potential tenants’ backgrounds and predicts their reliability so you reduce the risk of bad tenants. This means steady cash flow and fewer tenant-related issues.

Maintenance Prediction - AI predicts when maintenance will occur so you can manage proactively and reduce repairs. This means better property maintenance and higher tenant satisfaction.

Rent Collection - AI automates rent collection and sends tenants reminders so you can better manage cash flow. This means timely payments and less admin for property managers.

Portfolio Optimisation for the Property Investor

Diversification Strategies - AI helps investors optimise their portfolios by looking at the performance of different properties and recommending diversification strategies to reduce risk and increase returns. A property investment company can also help investors diversify their portfolios by providing expert advice and support. This means a more balanced and profitable portfolio.

Performance Monitoring - AI tools monitor properties in the portfolio in real-time and send alerts when certain metrics fall below target. This means investors can make adjustments and stay on top of their investments.

**AI Tools and Platforms for Property Investors in the UK **

Zoopla and Rightmove - These platforms use AI to provide property valuations, market trends and neighbourhood analysis so you can find and analyse investment properties and property investments. They have robust search functionality to help you find properties that match your criteria. By using AI, these platforms make the property search process faster and more targeted.

PropertyData - PropertyData uses AI to predict property values and market trends in the UK. It provides detailed analytics and reports so you can make data-driven decisions. By understanding rental income and the potential of rental property, you can assess buy to let opportunities better and maximise returns. This means more profitable investments and better market insight.

Hometrack - Hometrack aggregates data from multiple sources using AI so investors can get property and market insights. Hometrack can help investors evaluate residential property and make informed property purchases. Its platform helps investors make informed decisions with detailed analysis and predictions.

Summary

AI is changing the face of property investment in the UK. From data to risk management, AI has the tools to help you make better decisions, be more efficient and get more returns. By using AI, you can stay ahead of the game and make more informed investments.

Ready to level up your property investment? Check out the AI tools and platforms above. If you want to learn more, book a call with our team. We’ll help you fine-tune your strategy and get more out of AI for your property investment.

AI in property investing goes beyond data crunching—it's your roadmap to smarter decisions, higher returns, and lower risk Social Network Latest Listings Image of a cozy room with a chair and a fireplace

Windermere Rd, London W5 4TH, UK

£2,000 / Month

Potier St, London SE1 4UX, UK

£394,000

Warrington Rd, Harrow HA1 1SY, UK

£2,050 / Month